(Education & Teaching) ENGINEERING BURSARIES (Architecture, Building Science & Management, Construction & Building, General Built Environment, Land Surveying, Project Management, Quantity Surveying, Safety, Town and Regional Planning, Artisan/ Skilled Tradesmen ) EDUCATION BURSARIES

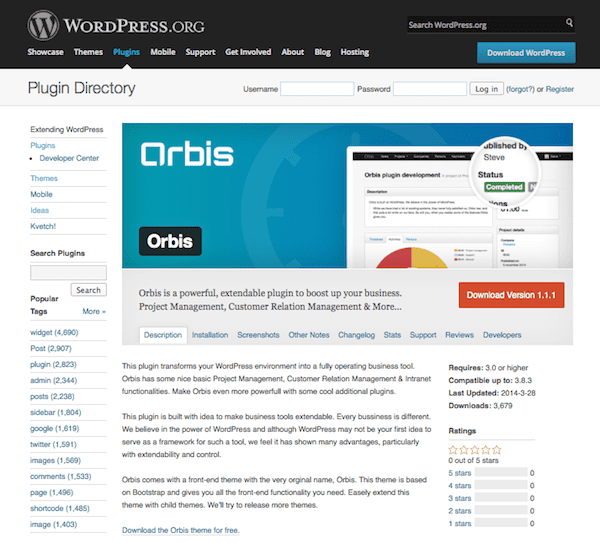

ORBIS INVESTMENT MANAGEMENT LIMITED SOFTWARE

(Computer Engineering, Computer Sciences, Graphic Design & Game Graphics, Informatics & Information Systems, Information Technology, Information and Communications Technology, Multimedia & Interactive Media, Software Engineering & Software Development) CONSTRUCTION & BUILT ENVIRONMENT BURSARIES (Asset Management, Business Related, Corporate Governance, Economics, Fiscal and Public Policy, General Commerce, Human Resources, Investment, Marketing, Purchasing & Buying, Risk Management, Sales & Retail, Transport Economics) COMPUTER SCIENCE & IT BURSARIES (Dance, Drama & Theatre, Fashion & Textile, Film & Motion Picture, Fine Art & Visual Art, Jewellery Design, Performing Arts, Music) COMMERCE BURSARIES (Auditing, Chartered Accounting, Financial Accounting, Finance & Financial Management, General Accounting) ARTS BURSARIES

ORBIS INVESTMENT MANAGEMENT LIMITED HOW TO

How to write a bursary motivational letter.

Our Banking Cloud and Reporting Studio solutions enhance and transform regulatory compliance, enable a consistent view of risk and go beyond the regulatory to provide banks with confidence to act on their plans.View all bursaries OPEN for application here “As technology is driving innovation in banking, we are combining that technology with our deep regulatory expertise to create effective, scalable and fully integrated solutions that can grow with our clients. Moody’s Analytics offers an end-to-end regulatory reporting platform, Reporting Studio, part of Banking Cloud-an eco-system of cloud-native banking solutions-that combines the regulatory methods, calculation, and reporting, and by so doing streamlines the entire regulatory reporting process. Changing regulatory requirements, large numbers of reports to be submitted, tight submission deadlines, data issues, and increasing costs are some of the challenges facing banks with respect to them meeting their regulatory reporting obligations.

0 kommentar(er)

0 kommentar(er)