Opening a checking account with Wells Fargo is a pretty straightforward process.

#Open an account with wells fargo how to

BANK How To Open A New Wells Fargo Checking Account READ MORE: SEE THE BEST BANK OFFERS FROM U.S. Most promotions are only available for new Wells Fargo customers.Some Wells Fargo checking accounts come with monthly fees, so make sure you’re aware of these before you sign up. Most Wells Fargo promotions and bonuses have a time limit, so make sure you’re able to meet the requirements before the offer expires. Wells Fargo’s promotions and bonuses often have specific requirements, like setting up direct deposit or making a certain number of debit card transactions, that you’ll need to meet in order to qualify. First of all, make sure you read the fine print.However, there are a few things you should know before you get started: These can be a great way to earn some extra cash or other rewards just for signing up and meeting certain requirements. If you’re thinking about opening a new Wells Fargo checking account, it’s worth checking out their current promotions and bonuses.

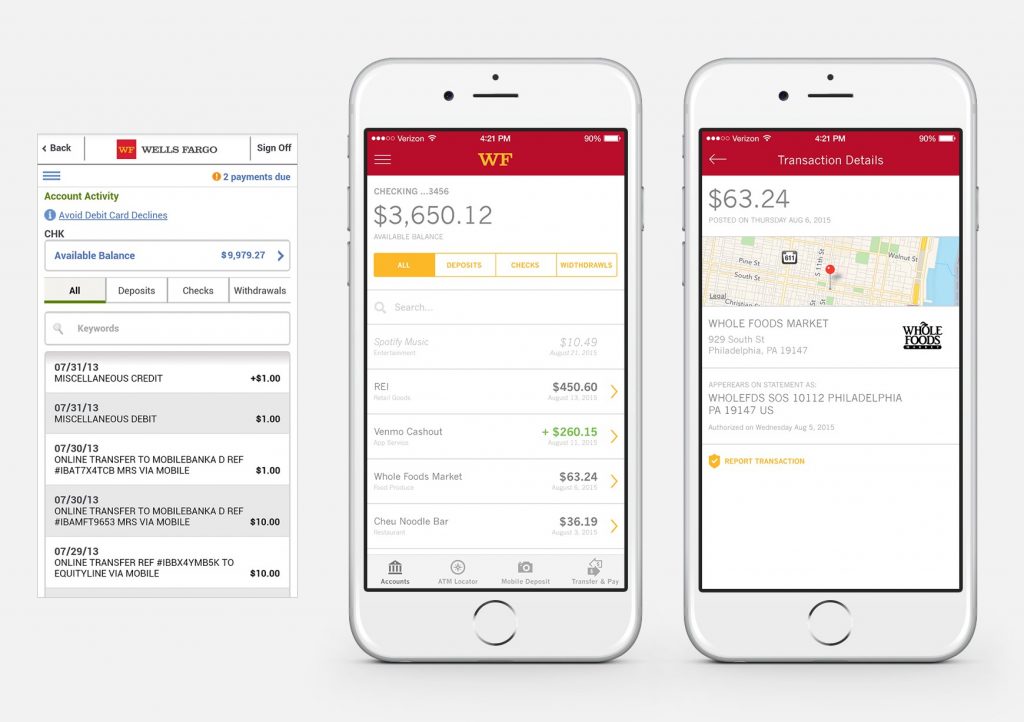

READ MORE: COMPARE WITH THE BEST BANK PROMOTIONS FROM CHASE What You Need To Know About Wells Fargo Promotions You can access your money from almost anywhere in the world with your Wells Fargo ATM/debit card. Wells Fargo checking accounts come with a variety of add-on services, like online bill pay and mobile deposit, that can help you manage your money more easily. With Wells Fargo, you can link your checking account to another account, like a savings account, to help cover you in case you accidentally overdraw. For example, they might offer $200 for opening a new account and setting up direct deposit. Wells Fargo often runs promotions where you can earn cash bonuses for opening a new checking account or meeting certain requirements. Plus, you’ll have access to thousands of ATMs where you can withdraw cash or check your balance for free.

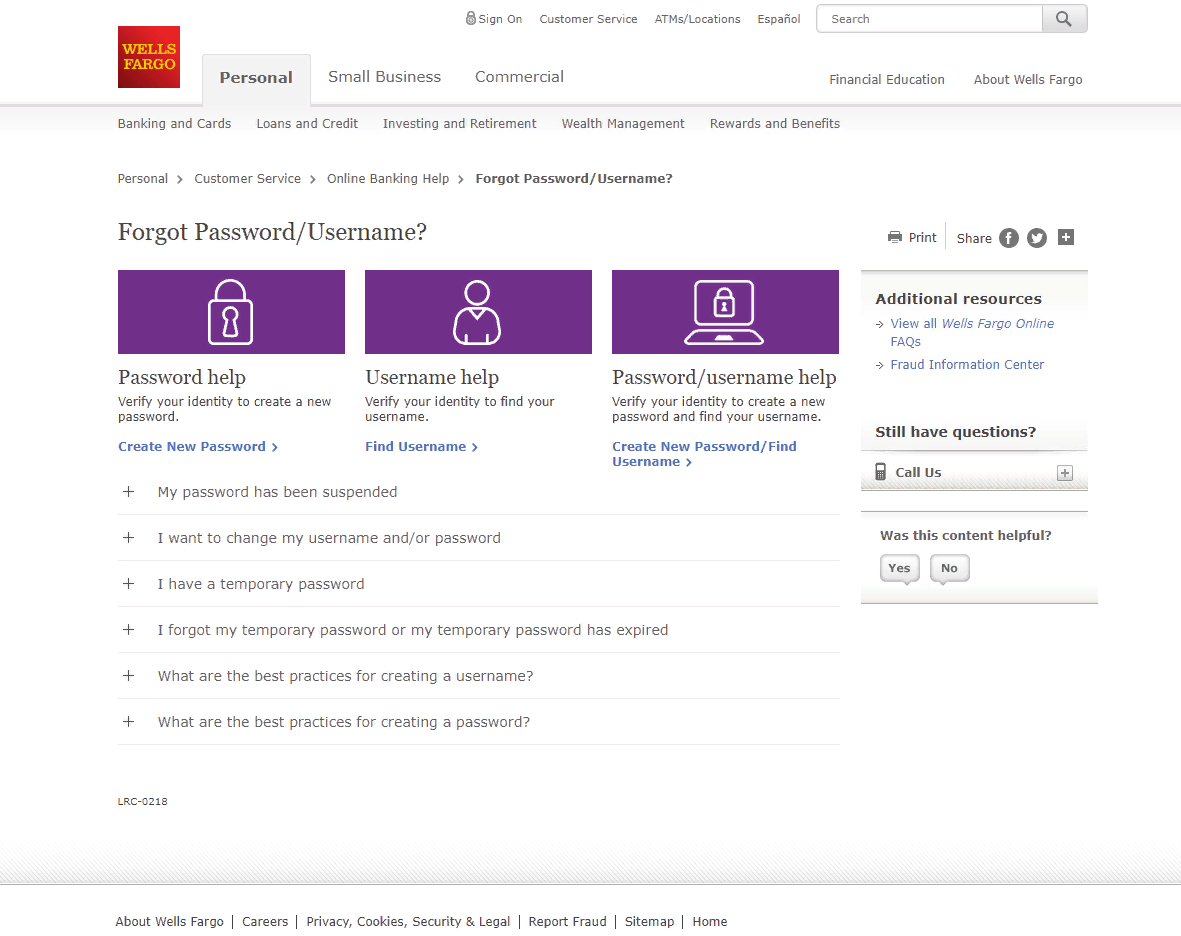

With Wells Fargo, you can bank online, on your mobile device, or in person at one of their many branches. Here are some reasons why a Wells Fargo checking account might be right for you: Not only do they have a wide network of ATMs and branches, but they also offer a variety of checking account options to fit different needs. Wells Fargo is one of the biggest and most well-known banks in the US. READ MORE: WELCOME OFFERS FROM CHASE, BANK OF AMERICA, TD BANK, AXOS, BMO HARRIS AND FIFTH THIRD BANK. As with other business checking accounts, direct deposit isn't a requirement for earning the bonus. This promotion is available in-branch only.

The Regulation D Penalty is seven days’ simple interest on the amount withdrawn and applies to: Penalties could reduce earnings on this account. You may pay an early withdrawal penalty or a Regulation D penalty if you withdraw funds from your account before the term is complete.

0 kommentar(er)

0 kommentar(er)